Cyber Security News Aggregator

.Cyber Tzar

provide acyber security risk management

platform; including automated penetration tests and risk assesments culminating in a "cyber risk score" out of 1,000, just like a credit score.The Equifax Breach Settlement Offer is Real, For Now

published on 2022-12-20 20:08:40 UTC by BrianKrebsContent:

Millions of people likely just received an email or snail mail notice saying they’re eligible to claim a class action payment in connection with the 2017 megabreach at consumer credit bureau Equifax. Given the high volume of reader inquiries about this, it seemed worth pointing out that while this particular offer is legit (if paltry), scammers are likely to soon capitalize on public attention to the settlement money.

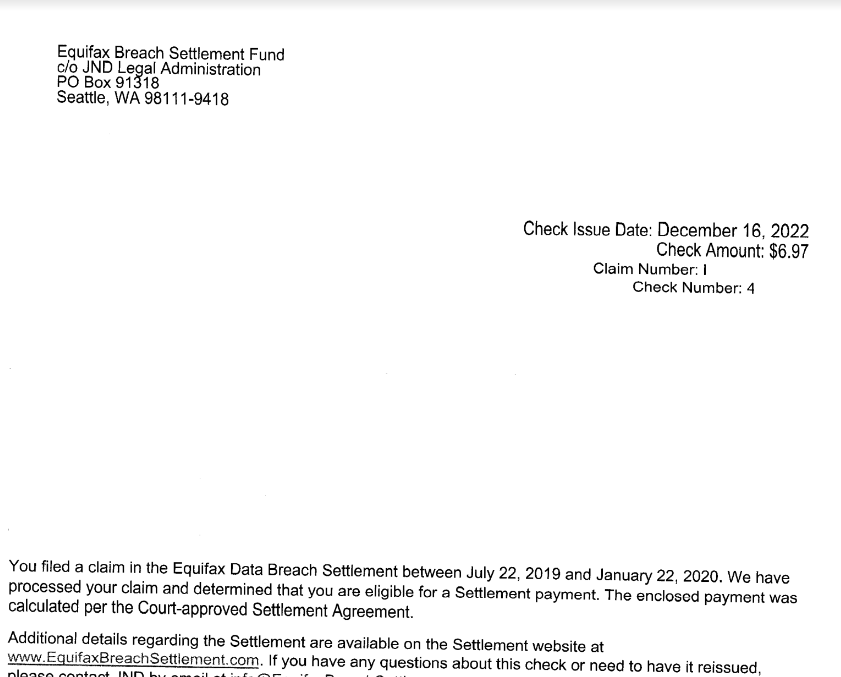

One reader’s copy of their Equifax Breach Settlement letter. They received a check for $6.97.

In 2017, Equifax disclosed a massive, extended data breach that led to the theft of Social Security Numbers, dates of birth, addresses and other personal information on nearly 150 million people. Following a public breach response perhaps best described as a giant dumpster fire, the big-three consumer credit reporting bureau was quickly hit with nearly two dozen class-action lawsuits.

In exchange for resolving all outstanding class action claims against it, Equifax in 2019 agreed to a settlement that includes up to $425 million to help people affected by the breach.

Affected consumers were eligible to apply for at least three years of credit monitoring via all three major bureaus simultaneously, including Equifax, Experian and Trans Union. Or, if you didn’t want to take advantage of the credit monitoring offers, you could opt for a cash payment of up to $125.

The settlement also offered reimbursement for the time you may have spent remedying identity theft or misuse of your personal information caused by the breach, or purchasing credit monitoring or credit reports. This was capped at 20 total hours at $25 per hour ($500), with total cash reimbursement payments not to exceed $20,000 per consumer.

Those who did file a claim probably started receiving emails or other communications earlier this year from the Equifax Breach Settlement Fund, which has been messaging class participants about methods of collecting their payments.

How much each recipient receives appears to vary quite a bit, but probably most people will have earned a payment on the smaller end of that $125 scale — like less than $10. Those who received higher amounts likely spent more time documenting actual losses and/or explaining how the breach affected them personally.

So far this week, KrebsOnSecurity has received at least 20 messages from readers seeking more information about these notices. Some readers shared copies of letters they got in the mail along with a paper check from the Equifax Breach Settlement Fund (see screenshot above).

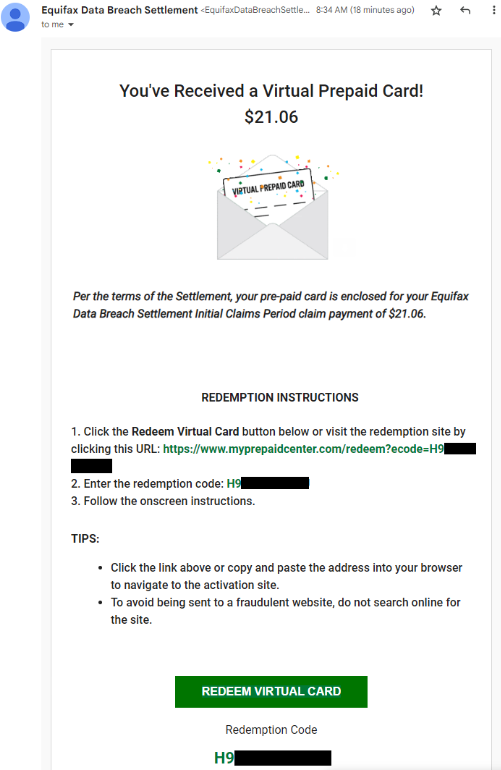

Others said they got emails from the Equifax Breach Settlement domain that looked like an animated greeting card offering instructions on how to redeem a virtual prepaid card.

If you received one of these settlement emails and are wary about clicking the included links (good for you, by the way), copy the redemption code and paste it into the search box at myprepaidcenter.com/redeem. Successfully completing the card application requires accepting a prepaid MasterCard agreement (PDF).

The website for the settlement — equifaxbreachsettlement.com — also includes a lookup tool that lets visitors check whether they were affected by the breach; it requires your last name and the last six digits of your Social Security Number.

In February 2020, the U.S. Justice Department indicted four Chinese officers of the People’s Liberation Army (PLA) for perpetrating the 2017 Equifax hack. DOJ officials said the four men were responsible for carrying out the largest theft of sensitive personal information by state-sponsored hackers ever recorded.

Equifax surpassed Wall Street’s expectations in its most recently quarterly earnings: The company reported revenues of $1.24 billion for the quarter ending September 2022.

Of course, most of those earnings come from Equifax’s continued legal ability to buy and sell eye-popping amounts of financial and personal data on U.S. consumers. As one of the three major credit bureaus, Equifax collects and packages information about your credit, salary, and employment history. It tracks how many credit cards you have, how much money you owe, and how you pay your bills. Each company creates a credit report about you, and then sells this report to businesses who are deciding whether to give you credit.

Americans currently have no legal right to opt out of this data collection and trade. But you can and also should and freeze your credit, which by the way can make your credit profile less profitable for companies like Equifax — because they make money every time some potential creditor wants a peek inside your financial life. Also, it’s probably a good idea to freeze the credit of your children and/or dependents as well. It’s free on both counts.

https://krebsonsecurity.com/2022/12/the-equifax-breach-settlement-offer-is-real-for-now/

Published: 2022 12 20 20:08:40

Received: 2022 12 20 20:21:19

Feed: Krebs on Security

Source: Krebs on Security

Category: Cyber Security

Topic: Cyber Security

Views: 3