Cyber Security News Aggregator

.Cyber Tzar

provide acyber security risk management

platform; including automated penetration tests and risk assesments culminating in a "cyber risk score" out of 1,000, just like a credit score.Who Controls China’s Car Market?

published on 2025-09-28 17:20:00 UTC by Snutz37Content:

- BYD, Changan, Chery, and Geely collectively make up more than half of China’s vehicle sales.

- Companies such as Nio, Xpeng, and Xiaomi continue to operate separately but encounter increasing challenges.

- Numerous Chinese automotive brands may not endure the next decade.

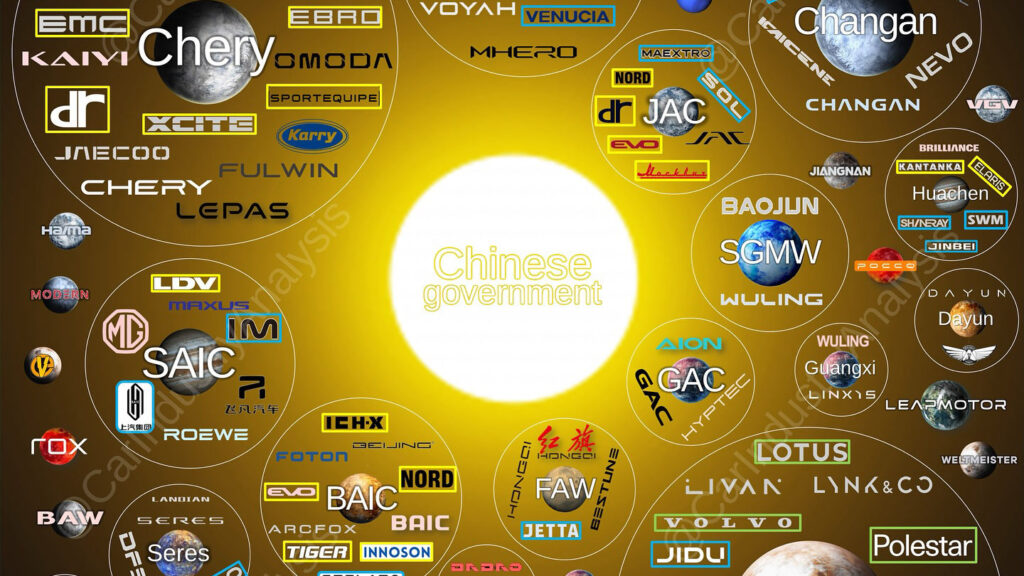

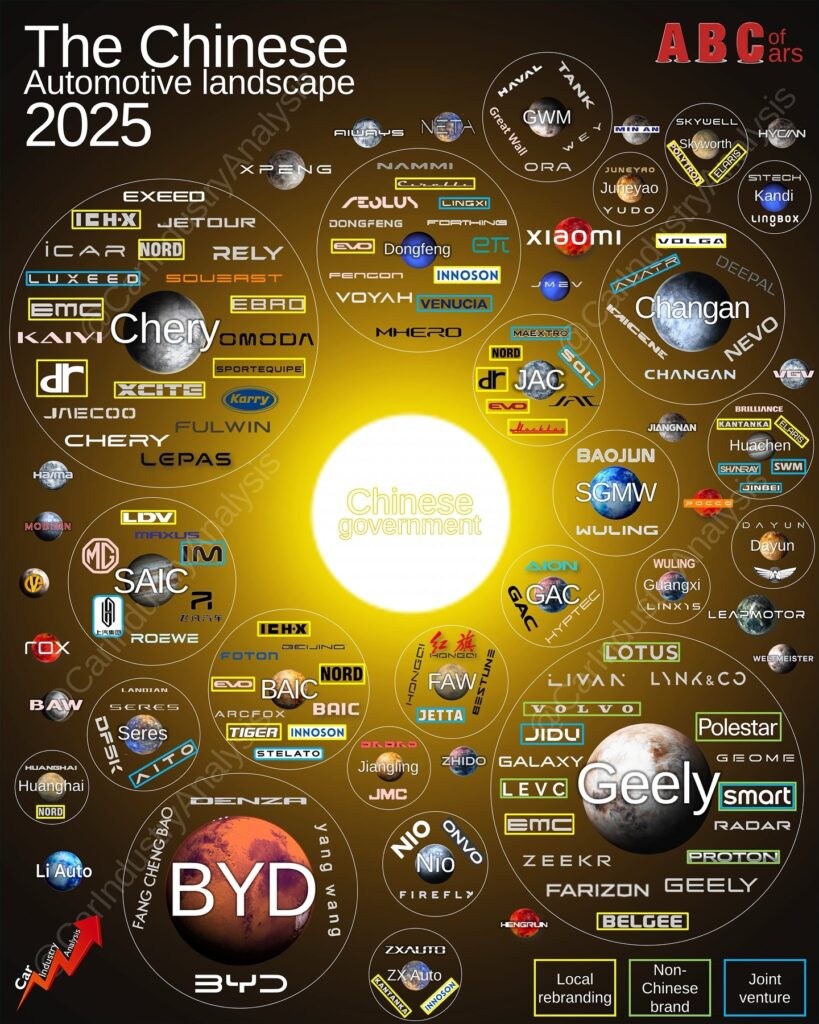

Do you have difficulty understandingChina’s car marketand the overwhelming variety of brands it houses? If that’s the case, then this comprehensive infographic is designed to make the country’s automotive sector a bit more comprehensible. However, be warned, examining it could leave you with just as many questions as answers.

This chart, compiled by industry analyst Felipe Munoz, outlines all the car manufacturers that are fully or partially owned by Chinese companies. Regarding sales, the four largest groups in the country are Geely, BYD, Chery, and Changan. The latter two are especially notable, as they are both state-owned.

Who Owns What?

Some of the brands under the Chery group include Fulwin, Omoda, Jetour, Exeed, iCar, Luxeed, Jaecoo, Rely, and the Chery brand itself. WithinChanganyou will encounter Avatr, Deepal, Nevo, Volga, and Kaicheng.

Then there’s Geely. Brands it owns either fully or partially include Zeekr, Proton, Farizon, LEVC, Galaxy, Volvo,Lotus, Lynk & Co, Polestar, Smart, Geome, Belgee, and Radar. In comparison, BYD’s lineup is much simpler, including its own brand along with Denza, YangWang, and Fan Cheng Bao.

Read: China’s EV Fire Causes Battery to Launch Into Traffic, Making It Their Responsibility

As mentioned by Munoz, these four groups make up 56 percent of the total.Chinese car sales. All of them are supported by the local government, and in this chart, the companies situated nearest to the sun are those with the highest level of state involvement.

The Wider Circle

In addition to China’s Big 4, other significant enterprises include SAIC, which owns theMG, LDV, Maxus, IM, and Roewe brands, JAC which owns Maextro, JAC, Evo, and Nord, as well as BAIC, which includes Arcfox, Foton, Tiger, and Stelato. There’s also Dongfeng, which owns the MHero, Voyah, Lingxi, Nammi, and Venucia brands.

Several prominent startups have managed to escape acquisition by major corporations. Among them is Nio, which has since introduced the Onvo and Firefly brands.Leapmotor, Xpeng, Aiways, Neta, Xiaomi, Li Auto, and Rox.

Boosting China’s Automotive Brands Based on Rank

In addition, Munoz also shared a second charton Instagram with a pyramid illustrating how 109 brands are positioned in the market. At the top are ultra-premium brands like Hongqi, YangWang, and Maextro. One step below are high-tech contenders such as Xiaomi, Nio, and Li Auto.

Underneath, the premium and semi-premium categories are filled with names such as Stelato, Denza, Zeekr, and Xpeng, all aimed at buyers who value status. The lower end is populated by older, cost-oriented brands that are largely unfamiliar in the West, such as Sinogold, Hima, Pocco, and others. These brands face the possibility of fading into obscurity as consumers shift towards more sophisticated, connected vehicles.

Survival Of The Fittest

All that considered, it’s very improbable that all these brands will still exist a decade from now. Although the major companies are likely to remain, they might decide to merge some of their sub-brands or eliminate them completely, a trend that has been common in the West with names such as Pontiac, Oldsmobile, NSU, Autobianchi, Sunbeam, and hundreds of other brands that have vanished from dealerships over the years.

It is evident that Chinese automobile producers are here to stay and will remain a significant force in the global market for many years ahead.

The post Who Controls China’s Car Market? appeared first on FondTimes.

https://fondtimes.com/2025/09/28/who-controls-chinas-car-market/

Published: 2025 09 28 17:20:00

Received: 2025 09 29 03:42:05

Feed: CyberPunk

Source: CyberPunk

Category: Cyber Security

Topic: Cyber Security

Views: 15